Often relegated to the bottom of the specification sheet, electric car motors are of crucial importance in terms of economy, performance and industrialisation.

When we talk about electric cars, the first thing we talk about is range. Unlike the world of internal combustion vehicles, where cylinders are omnipresent and sometimes more famous than the cars themselves, like the V12 Bizzarini and other ‘in-line sixes’, when it comes to watts, engines are generally relegated to the background and it sometimes seems as though there is only one type of engine for all electric cars. In fact, the opposite is true! Whether already produced on a large scale, present in niche models or still in the gestation stage, there are several types of electric car motor, of which the following are the main ones.

Permanent magnet synchronous (PMSM) electric car motors

Widely used in electric cars, the PMSM motor works thanks to magnets containing neodymium, a rare earth, which, placed in the rotor (the rotating part), rotate according to the magnetic field generated by the stator (the fixed part). It is highly efficient, with energy yields well in excess of 90%, making it ideally suited to the automotive industry. If we add to this the fact that it is very compact and fairly light, this makes it, despite its relatively high cost due to raw materials, the motor of choice for many well-known models such as the Nissan Leaf or the Toyota Prius hybrid.

The asynchronous motor

Here, there are no magnets in the rotor. To put it very simply, the stator produces a magnetic field whose energy is transmitted to the rotor. The rotor in turn produces a magnetic field. The two fields, like a wrestler facing a boxer in an octagon, will then confront each other and make the rotor turn. Without permanent magnets, the induction motor is cheaper to produce than the PMSM. It is also more robust thanks to its simpler structure, and less sensitive to heat despite an average energy efficiency of just under 90%. Induction motors are found in Tesla Model S and X vehicles.

The variable reluctance synchronous motor or SRM

Here’s the SRM: no permanent magnets, no windings, no critical raw materials such as rare earths, just gears on the rotor and stator that create movement by aligning themselves. Inexpensive to manufacture, durable and capable of handling a lot of torque at low revs (ideal for an electric car). However, it is not very widespread and, for the moment, it is mainly the subject of research by start-ups. Why is this? For one thing, it’s noisier than its counterparts. But that’s not its only drawback. It’s also electronically controlled, which adds a whole host of data to integrate, making it complex to manage.

Axial-flow electric car motors

This is the motor that could well change the face of the world. Here, unlike in radial flux motors, the movement of the magnetic field is parallel to the axis of rotation. In other words, axial flux motors are flat and therefore more compact, while retaining their efficiency. This architecture also makes it easier to cool the motor, thereby increasing its performance. Today, these motors are still too expensive to manufacture for large-scale deployment, but manufacturers are nonetheless paying close attention to developments in this technology. The latest example is Mercedes’ acquisition of the British company YASA, which specialises in axial-flow engines.

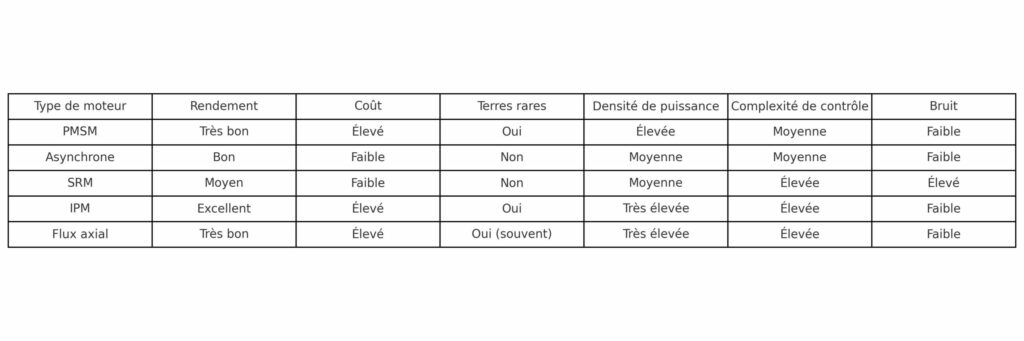

Summary :