The SCAPE project is funded by the 27 European countries as part of the Horizon Europe programme and led by the Energy Research Institute of Catalonia (IREC). The aim is to revisit the power electronics used in electric vehicles. What are SCAPE’s ambitions? To achieve an efficiency of over 97.5%, double the power density and halve the cost per kWh compared with current solutions.

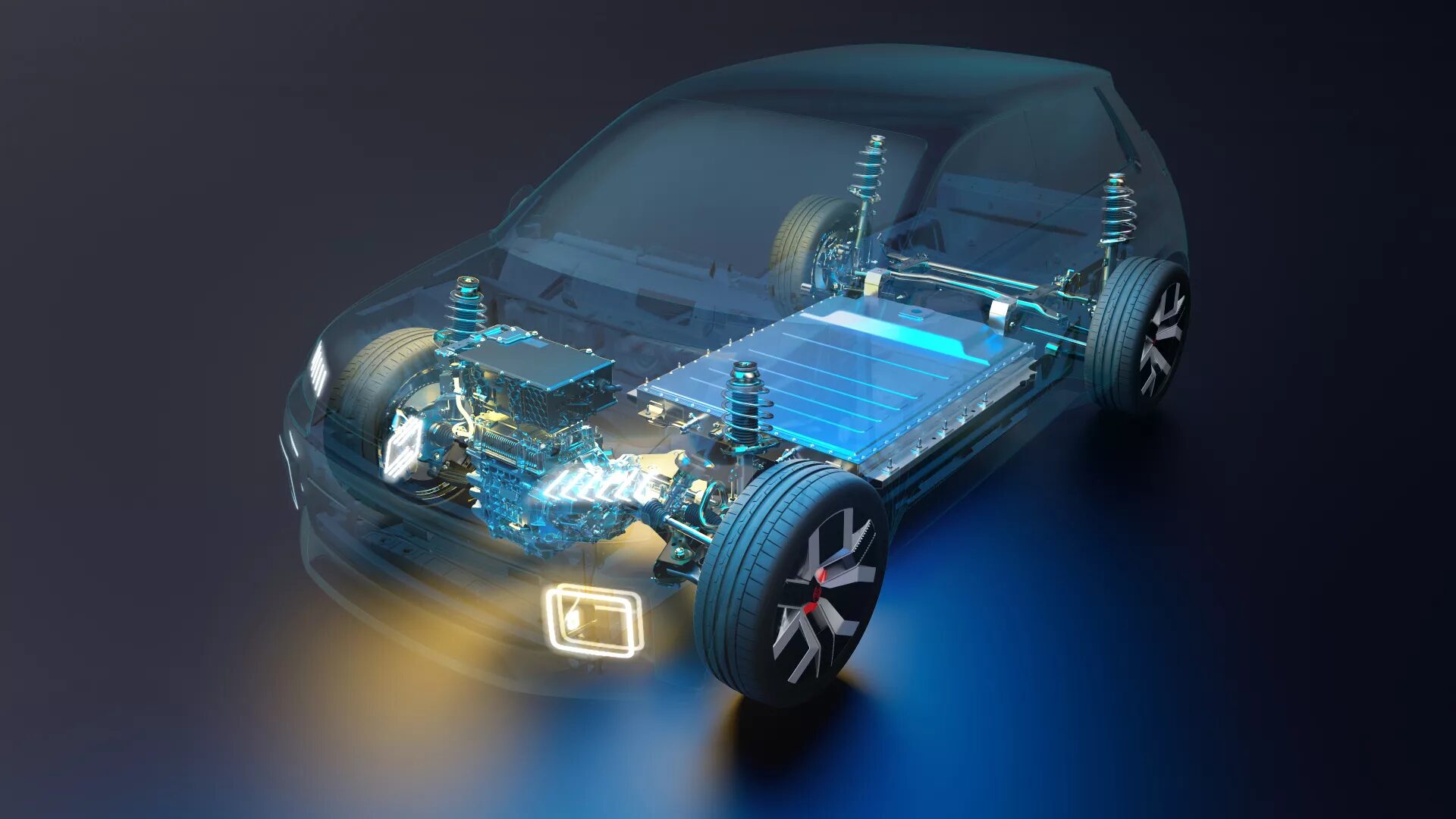

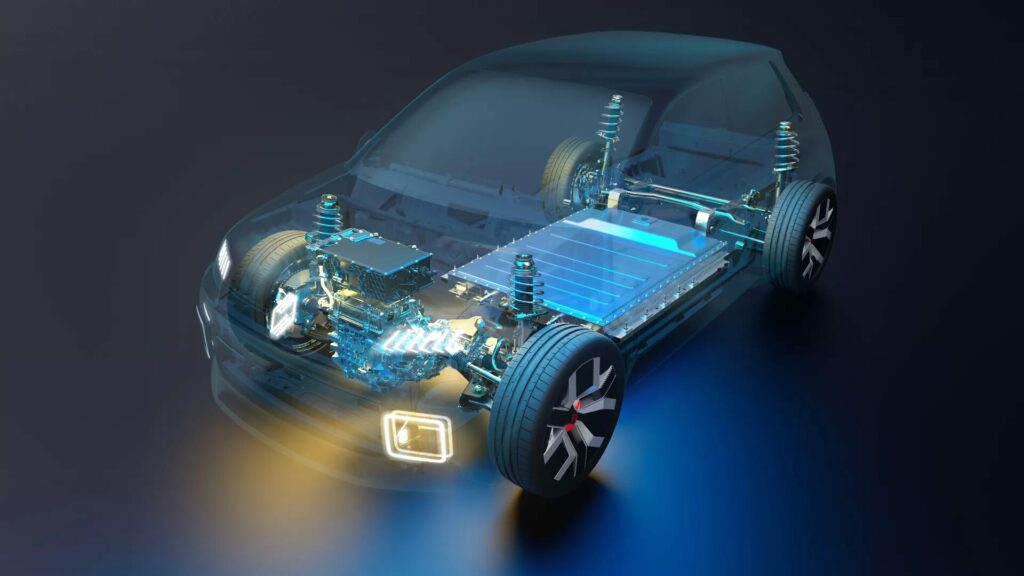

With the market for electric vehicles constantly evolving, carmakers still face many challenges. Such is the case with power electronics: all the electronic components that transform and control the electricity in an electric car.

The key idea behind the SCAPE project is modular technology. Rather than designing a different converter for each vehicle, IREC engineers are developing a “standard brick” called a switching cell. These small bricks can be stacked in series, like Lego, to obtain exactly the power required. These chains are then assembled to form a complete converter for the motor or charging system. The result is a common base that is equally suited to small city cars, vans and HGVs, promoting standardisation and reducing costs.

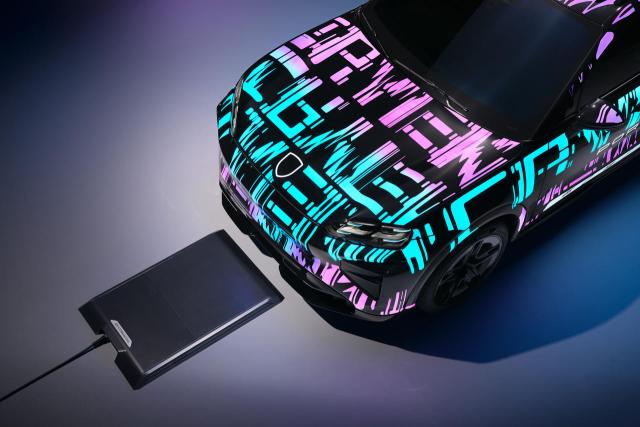

With an efficiency of over 97.5%, SCAPE hopes to improve the recharging performance of our electric vehicles. The project also aims to combine certain functions: traction inverters and on-board chargers can coexist in the same module, simplifying design and reducing the number of components required.

Not only that, but the power chips will be integrated directly into the electronic circuit boards. This innovation will improve cooling, reduce energy losses and increase the lifespan of the vehicle and its components.