The new 2026 version of Formula 1 has finally taken to the track. At the end of January, behind closed doors on the Barcelona circuit, the teams carried out a first discreet collective run, without any significant lap times. Far from being a show, these tests were above all an opportunity to validate the new technologies developed by the manufacturers and to gauge the extent of the change. This was the first concrete glimpse of a regulation that marks the most profound change since the introduction of the hybrid era in 2014.

2026: a profound change

The 2026 regulations are an in-depth update that marks an almost complete reboot, both in terms of the engine and chassis.

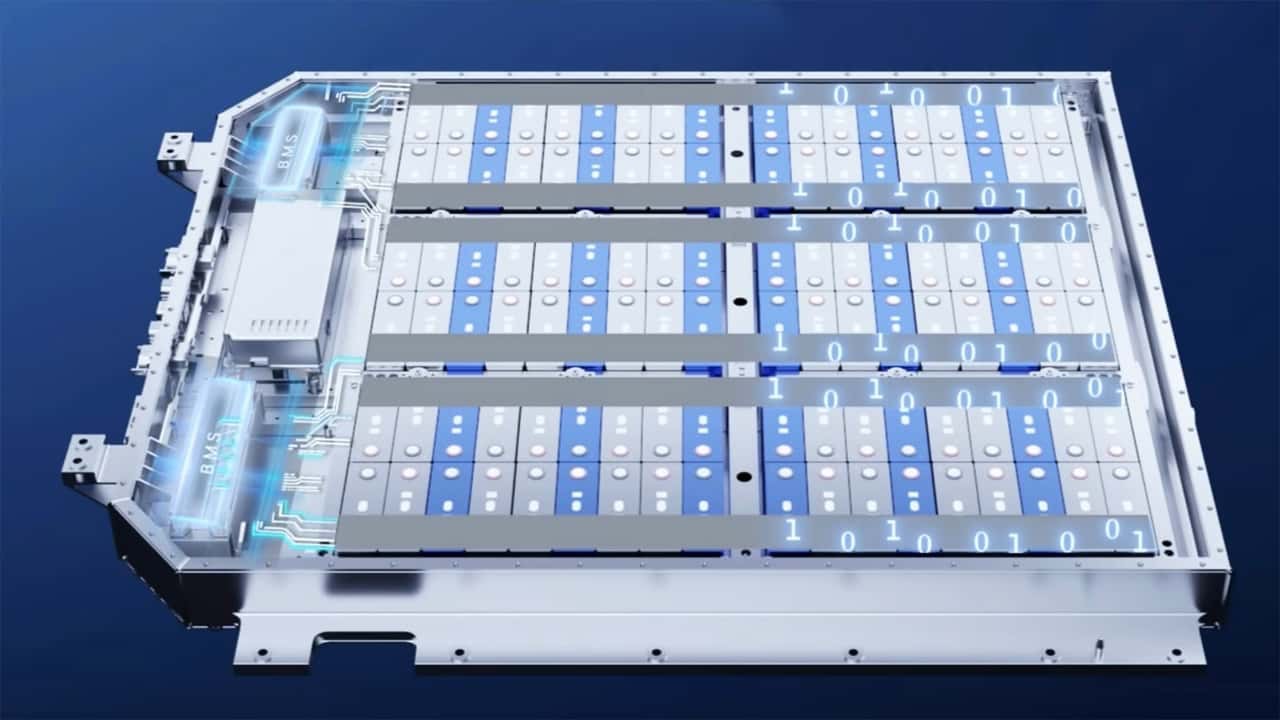

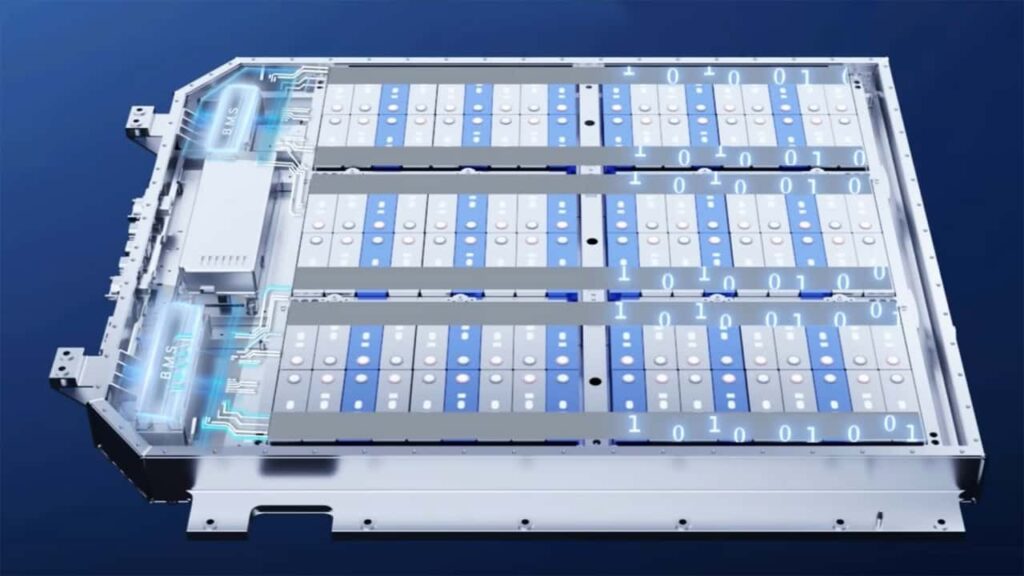

While the F1 retains its 1.6-litre V6 turbocharged engine, its hybrid architecture has changed radically. The MGU-H has disappeared, eliminating one of the most complex and expensive elements of the current generation. The MGU-K, on the other hand, has seen its power almost triple, from 120 kW to 350 kW, or almost 475 electric horsepower.

The aim of this change is to achieve a near 50/50 split between internal combustion and electric vehicles, compared with around 80/20 today, all using 100% sustainable fuel.

In terms of chassis and aerodynamics, the 2026 cars are more compact and around 30 kg lighter. Active aerodynamics become central, with movable front and rear wings and two distinct modes: high downforce in corners and low drag in a straight line. DRS as we know it will disappear, replaced by a system combining drag reduction and electric ‘burst’.

The FIA’s promise is twofold: more agile single-seaters, less dependent on pure aerodynamic downforce, and a greater role for the driver in managing energy and modes.

Barcelona tests: a shakedown under close scrutiny

This first run took place from 26 to 30 January 2026 in Barcelona. Officially presented as a simple “shakedown”, a validation drive designed to check that the basic systems were working properly (starting, braking, cooling, reliability), it was in fact the first full-scale test of the 2026 F1 cars, with work already well advanced on engine integration, active aerodynamics and energy management.

The eleven teams were allowed to ride for up to three days each in a five-day window. All of this took place behind closed doors, without the public or the media, with very few images broadcast. The aim was not to put on a show, but to validate the technical aspects: to check that the new power units are working, that the active aero systems are reliable and that the cars can complete lap after lap without any major problems before the official tests in Bahrain, which start on February 11.

What the first rounds highlighted

Although information is still being filtered, a number of key trends have emerged from these initial tests, all linked to the interaction between the new hybrid engine and the aerodynamic design of the single-seaters.

The first major lesson is energy management.

Identified as a sensitive point in the simulations, it was confirmed in Barcelona as the heart of the 2026 challenge, directly linked to the new powertrain. With a much more powerful MGU-K, the battery discharges very quickly as soon as the driver tries to maximise performance in a straight line. The FIA has already shown that if the aerodynamics are overloaded, the electrical energy can run out before the end of the straight.

In Barcelona, the emphasis was on transitions between aerodynamic modes and on the ability to conserve energy to attack or defend at the end of the straight. Performance is no longer based on raw power, but on a constant balance between engine, battery and aerodynamics.

More demanding piloting

The cars are lighter and quicker out of corners, which improves agility. On the other hand, the simultaneous management of energy, aero modes and electric deployment phases adds an unprecedented layer of complexity for the drivers, who have to relearn how to tame this 1,000-horsepower beast.

Indeed, the FIA and the teams have announced that the learning curve will be more difficult than during the 2021 to 2022 changes: driving will become a more complex exercise in anticipation and management.

New hybrid engine: impressive power, but still a learning curve

The first media releases from the drivers and technical boards are unanimous: these new single-seaters are powerful and complex.

Mercedes driver George Russell spoke to ESPN and described the electric power as “quite impressive”. He is probably talking about the highest top speeds ever seen in Barcelona when the electrics are fully deployed. What’s more, he says, driving is instinctive and the reduction in size of the cars is appreciable. Mercedes engineers confirm that the torque and acceleration are particularly noticeable when the battery is fully charged.

Also from the German manufacturer, Andrew Shovlin, Director of Engineering, commented. He added that, in terms of feel, while the drivers had previously been confined to simulator tests, the real-life behaviour on the track was better than some of the champions had expected.

But of course, as we explained earlier, the new regulations mean that the drivers have to adapt and learn. On this subject, Liam Lawson (Racing Bulls) explains that he has “not yet fully grasped” everything he has to deal with, and that it will take the Bahrain tests to really master the options available in terms of energy modes and attack/defence in the race.

A phase of understanding before performance

These Barcelona tests mark the start of an essential phase: that of understanding and apprehension. The teams will now be analysing the data they have gathered before introducing changes as early as the Bahrain tests.

Above all, this first drive confirms one thing: F1 2026 will be neither a simple continuation nor a Formula E in disguise. It promises to be a discipline more focused on energy efficiency, power strategy and active driving.