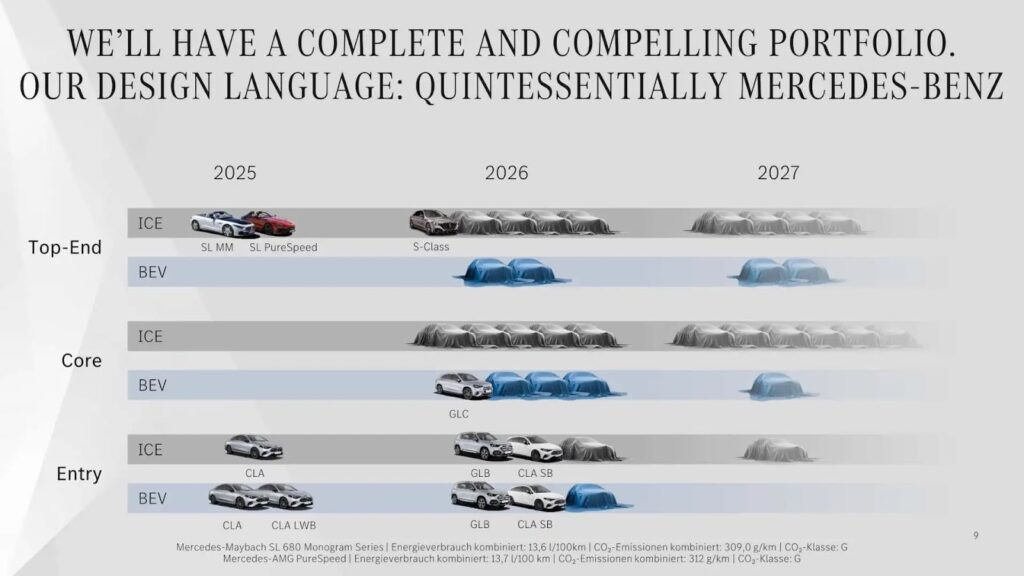

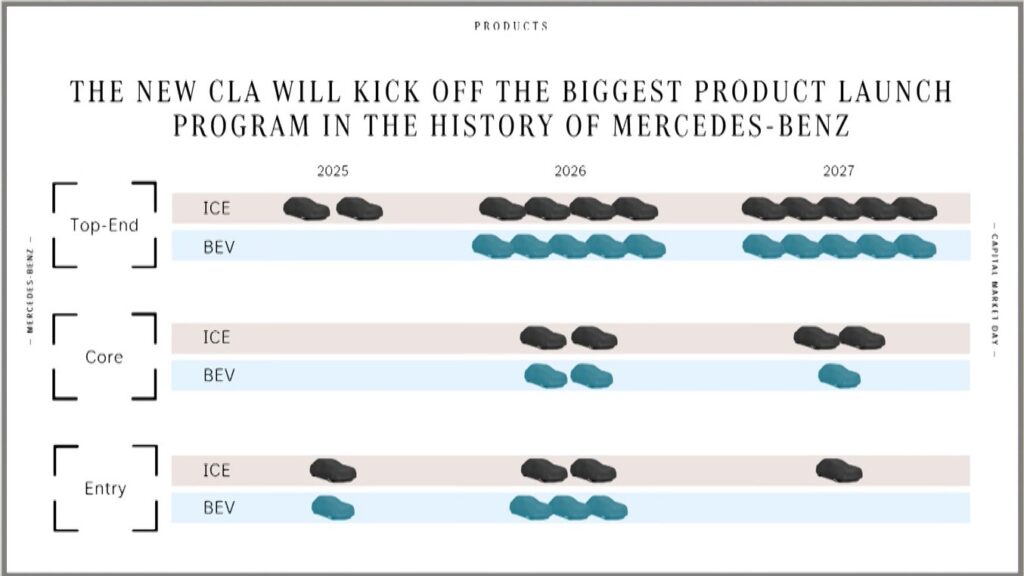

Mercedes-Benz is stepping up its electrification strategy with an ambitious timetable for 2026: a total of 16 new models, including six 100% electric models. These figures come from a graph unveiled during the German brand’s 2025 annual report. Mercedes is expanding its electric range without abandoning hybrids and premium combustion engines.

A massive programme of launches for 2026

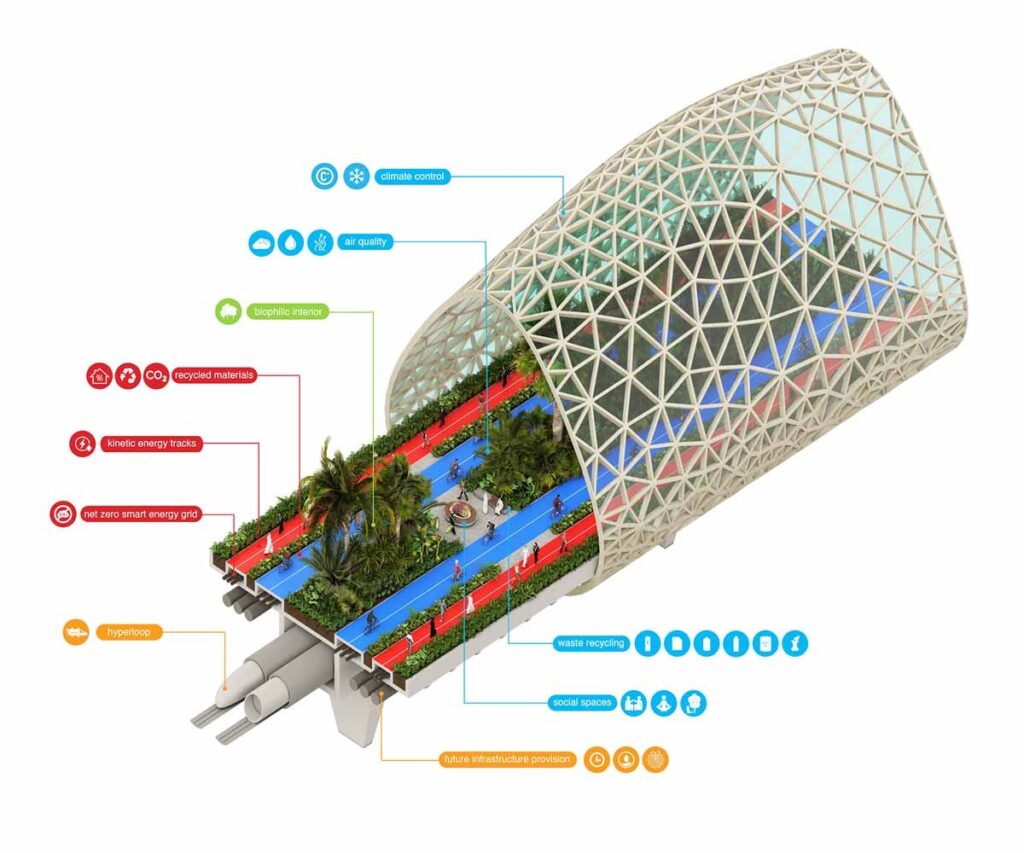

According to the illustration revealed by Mercedes-Benz on 12 February 2026, 16 new models will be launched in 2026, divided between 12 electrified vehicles (pure electric and plug-in hybrids) and 4 restylings. The first six 100% electric models are part of a strategy to achieve 50-60% electrified sales in Europe by 2030.

This offensive comes against a backdrop of contrasts for Mercedes: the manufacturer plans to sell 168,800 100% electric vehicles (BEVs) worldwide in 2025, down 9% on 2024, representing just 9 to 10% of its total sales of 1.8 million units worldwide. Moderate growth, held back in particular by competition from China. Mercedes-Benz plans to sell around 250,000 to 300,000 plug-in hybrids (PHEVs) worldwide by 2025, representing 15 to 18% of total passenger car sales.

Six electric models at the heart of the strategy

The first six electric models to be announced are based on the new MMA (Modular Mercedes Architecture) and EVA2 platforms, and all boast ranges in excess of 650km WLTP and compatibility with 800V ultra-fast charging.

The manufacturer categorises its vehicles into three classes: Top-End (S-Class, EQS, G-Class), Core (E-Class, EQE, C-Class, GLC) and Entry (GLA, CLA, etc.).

For the Top-End category, Mercedes has revealed that two new models will be launched in 2026. The first is likely to be the 4-door AMG GT. The other new top-of-the-range model could be the VLS van, a variant of the VLE. As we have seen, 2027 will also bring two more BEVs, one of which is expected to be the SUV version of the 4-door AMG GT.

In the Core segment, what is certain is that 2026 will see the birth of the electric C-Class from the first quarter. Other mid-range Mercedes models could be added, such as a C-Class estate (T-Modell) or a GLC Coupé. A BEV will see the light of day in 2027, probably an electric E-Class, announced earlier by Mercedes director Ola Källenius.

Finally, in the entry-level segment, the main new model expected is the GLA EQ. This would be the fourth and final model based on the Mercedes Modular Architecture (MMA), already used for the CLA, CLA Shooting Brake and new-generation GLB. An A-Class could also make a return to the range, as several specialist media have reported. However, its arrival would not be part of the immediate timetable: it would not be expected before 2028, or even beyond.

A revised strategy to reflect market realities

The 2026 offensive reflects a strategic recalibration for Mercedes-Benz. Initially, the group was aiming for 100% electric sales by 2030. This ambition was revised in 2024 in the face of slower-than-expected take-up. The new roadmap, “Ambition 2039”, now favours a mix: 50 to 60% electric by 2030, with hybrids and premium combustion engines to be maintained beyond that.

This approach will enable Mercedes to meet the expectations of premium customers who are attached to internal combustion engines, while at the same time stepping up the pace of electric vehicles where demand is confirmed and where the brand will have to comply with European requirements, in particular.

This time last year, the brand with the silver three-pointed star unveiled the same calendar for the year ahead. And the least we can say is that the BEV release targets have changed. In the Top-End segment, five BEVs were teased for 2026, but in the end only two. In the Core segment, too, the situation is different, but in the opposite direction: two 100% electric vehicles have been announced, compared with four at present. Only in the Entry segment does the brand not seem to have changed direction. This is a sign that these announcements, particularly for the three BEVs planned for 2027, are subject to change.

History and context of Mercedes electrification

Mercedes-Benz has been involved in electric vehicles since 2010 with the Smart ED, but the real offensive began in 2018 with the EQC, the first model in the EQ range. The range expands in 2021 with the EQA, EQB and EQS, reaching ten EQ models by 2023. By the end of 2025, nearly 370,000 EQ vehicles had been sold.

In 2025, the EQA and EQB combined will account for the majority of electric passenger car sales (~25,000 to 30,000 units estimated), while the EQS will maintain its premium volumes (~12,000 to 15,000 units), with WLTP ranges now between 400 and 750 km depending on the model. Although these figures are significant, with 168,800 BEVs sold worldwide, they still fall short of the initial “100% electric 2030” ambitions, justifying the strategic recalibration in 2024 and the massive offensive in 2026.

With 16 new models planned for 2026, including six 100% electric models in the first half of the year, Mercedes-Benz is confirming its commitment to the transition to electric vehicles, while adopting a pragmatic approach. Far from making a radical switch to all-electricity, the German manufacturer is favouring a balance between technological innovation, market realities and the expectations of premium customers. It is highly likely that the GLA EQ, the electric C-Class, the 4-door AMG GT and the VLE will be presented in the coming months. For the rest, it’s more uncertain, and we’re not immune to another change of strategy from Mercedes.