On 29 January 2026, the Ministry of the Interior published its press release entitled “Insecurity and crime in 2025: a first snapshot”, stating that the number of vehicle thefts would fall by 9% compared with 2024. With 125,200 vehicles stolen, compared with 137,600 the previous year, France is back to pre-Covid levels. But the most striking statistic concerns 100% electric vehicles: they account for less than 1% of thefts, a virtual immunity that can be explained by technological innovations that make these models less attractive targets for criminal networks.

125,200 thefts in 2025: a vehicle stolen every 4 minutes

On 29 January 2026, the Ministerial Statistical Service for Internal Security (SSMSI) published a preliminary analysis covering 87% of crimes and 74% of non-road offences. The document confirms 125,200 vehicle thefts in 2025, i.e. one vehicle stolen every 4 minutes in France.

This 9% fall on the 137,600 thefts recorded in 2024 comes after a 7% rise in 2023, bringing car crime back to levels comparable to those in 2019, before the pandemic. Despite this, France remains the most affected country in Europe.

The reporting rate remains stable at 57%, meaning that nearly 6 out of 10 thefts are reported to the police or gendarmerie.

Flight geography

Geographical disparities remain marked. Île-de-France alone accounts for 34% of national thefts, confirming its position as the region most affected. The Hauts-de-France region comes second with 17% of thefts, recording a worrying 29% increase in the risk of theft compared with 2024. The Provence-Alpes-Côte d’Azur region rounds out the top three with 15% of thefts, followed by Auvergne-Rhône-Alpes and Pays de la Loire.

These regions share common characteristics: proximity to international motorway routes, the presence of ports facilitating illegal exports to the Maghreb and sub-Saharan Africa, and a concentration of dense urban areas.

Which vehicles are the most targeted?

Compact city cars and SUVs, whether internal combustion or hybrid, dominate, accounting for between 80 and 90% of thefts. Hybrid vehicles will account for 53% of thefts in 2025, compared with 40% in 2023.

Roole’s top 5 stolen models

Roole, the car protection specialist with nearly a million active beacons in France, has published its ranking of the most stolen models, based on thefts detected in its equipped fleet. The data, based on a representative sample, sheds light on the trends observed nationwide in 2025.

At the top of the rankings is the Renault Clio, including generations IV and V, with 347 thefts recorded. It is well ahead of the Toyota RAV4 hybrid, which was targeted 162 times, followed by the Peugeot 208 with 131 thefts. Compact SUVs are not spared either, as the Peugeot 3008 is also among the vehicles most at risk, with 109 thefts, just ahead of the Renault Mégane IV, with 103.

In addition to these models, which are widely available on the French market, Roole has also observed a strong attraction for certain premium hybrid SUVs. Vehicles such as the DS 7 Crossback and BMW X5 are particularly sought after by theft rings, not least because of their high residual value and ease of resale on export markets.

Why are electric vehicles a marginal target?

The most striking statistic from 2025 concerns 100% electric vehicles: they account for less than 1% of the 125,200 thefts recorded, or less than 1,250 cases. No major electric model features in the top 10, or even the top 50, of stolen vehicles.

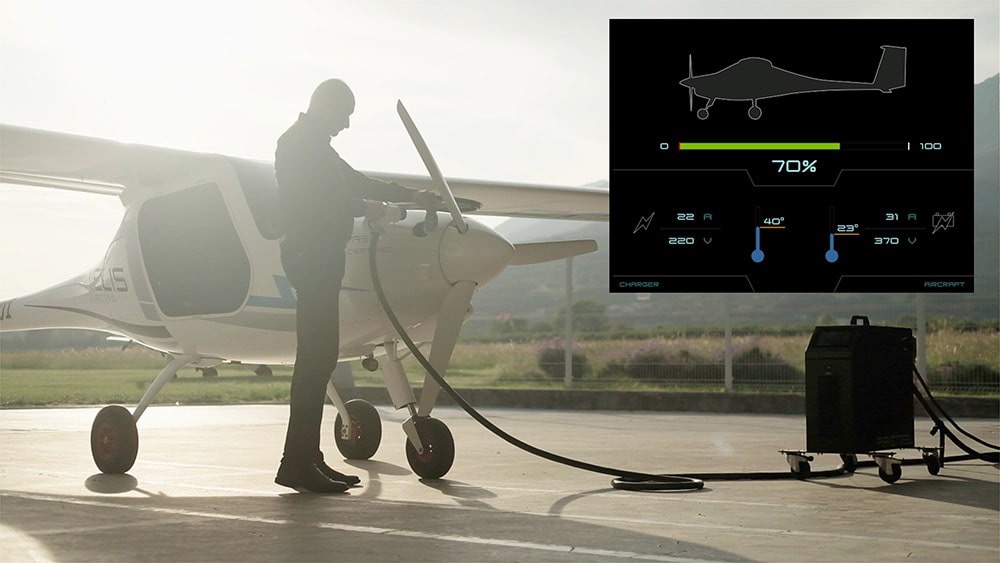

The reason for this lies in technological innovations that act as a deterrent. Most electric vehicles currently on the road in France incorporate new-generation security systems that mean they are very rarely targeted by kidnappers:

- UWB authentication and AES-256 encryption: the keys use ultra-wideband technology, capable of detecting relay attempts beyond 10 metres. The encryption code changes every 10 minutes. Tesla, for example, combines its Phone Key with a mandatory PIN code at start-up.

- OTA (Over-The-Air) updates: electric vehicles receive security patches in less than 24 hours, correcting vulnerabilities before mass exploitation. Renault 5 E-Tech, Peugeot e-208 and Tesla, among others, update their systems automatically.

- Secure architecture: the central gateway acts as a real firewall between the vehicle’s electronic system and the OBD socket. This prevents fraudulent direct access, a method used in the vast majority of electronic thefts from internal combustion vehicles, which now account for almost 94% of cases.

- Integrated geolocation: electric car batteries can incorporate highly accurate geolocation systems, capable of locating a vehicle to within five metres. As a result, when a car is stolen, it is recovered in around 9 out of 10 cases, compared with only 3 to 4 out of 10 cases for combustion-powered cars. At Tesla, the Sentry Mode system constantly monitors the vehicle’s surroundings using eight cameras, enabling any suspicious attempts to be detected and recorded.

An unsustainable flight economy

In addition to the technical safeguards, electric vehicles present prohibitive economic constraints:

- Batteries that can’t be sold legally: batteries are traceable and their resale is governed by strict regulations.

- Limited export market: stolen combustion-powered vehicles are exported on a massive scale to North Africa and Africa, where electric recharging infrastructure is virtually non-existent.

- Non-limiting range: contrary to popular belief, the range of electric vehicles (400 to 600 km) is not a limiting factor, as post-flight leaks are generally short (less than 100 km).

Gaël Musquet: “EVs incorporate a multi-layered defence system”.

Gaël Musquet, an ethical hacker and cybersecurity specialist based at the Cyber Campus in La Défense, offers a nuanced perspective. In an interview with us in June 2025, he stressed the principle of “resilience” rather than absolute invulnerability.

“No system is invulnerable. The real question is: how long will it take an attacker to bring it down? Electric vehicles incorporate a multi-layered defence: UWB authentication, rolling encryption, OTA updates and integrated geolocation. The UWB relay is hard to break without professional equipment, and OTA updates make exploits ephemeral. Conversely, combustion vehicles have ECUs that are vulnerable in 30 seconds via OBD-II.

Musquet does, however, warn of the potential vulnerabilities of charging points (fake QR codes, remote malware) that could threaten the electricity grid via vehicle-to-grid (V2G). His recommendations: apply OTA updates in the same way as on a smartphone, avoid using contactless keys, use mechanical locks and opt for guarded car parks.

Conclusion

The 9% fall in vehicle thefts by 2025 is evidence of an overall improvement, but 125,200 stolen vehicles are still a cause for concern. The striking reality is that 100% electric vehicles account for less than 1% of thefts, thanks to a combination of technological innovation and economic constraints that make them unattractive to criminal networks. Enhanced security is therefore an additional argument in favour of the transition to electromobility.