Aircraft are regularly at the centre of controversy over climate change and greenhouse gas emissions. So it’s only natural that the aeronautics industry, like the car industry before it, should be thinking about electrification (except that you don’t fly a 40-tonne steel monster like you do a city car).

At the heart of this relatively young market, which is set for exponential growth and is booming internationally, are a number of French players, both large groups and young start-ups, determined to make France a pioneer in electric aviation, just as it was a pioneer in thermal aviation.

The promise of French electric aircraft

In France, while Airbus has been active in the electrified aeronautics sector since the early 2000s, the most successful projects are to be found among start-ups. Aura Aero is one of the country’s most successful start-ups.

Based in Toulouse, the epicentre of aviation in Europe, this start-up flew its two-seater Integral E aircraft for the first time in December 2024. As its name suggests, the aircraft is powered by a 100% electric motor. A part supplied by a giant of the global aeronautics industry, the French group Safran. Called Engineus, it is the first electric aircraft engine in the world to receive certification from a major agency, the European Union Aviation Safety Agency (EASA), enabling it to go into series production.

Admittedly, the Integral E only offers between 1 h and 1 h 30 of autonomy, but it can be recharged in 30 minutes, so it can be used for regional round trips, or simply for training future pilots. And this is just the beginning for Aura Aero, which, alongside the Integral E, has also developed the ERA, capable of carrying 19 passengers, again for regional routes. Equipped with a hybrid engine, it should make its first flights in 2026.

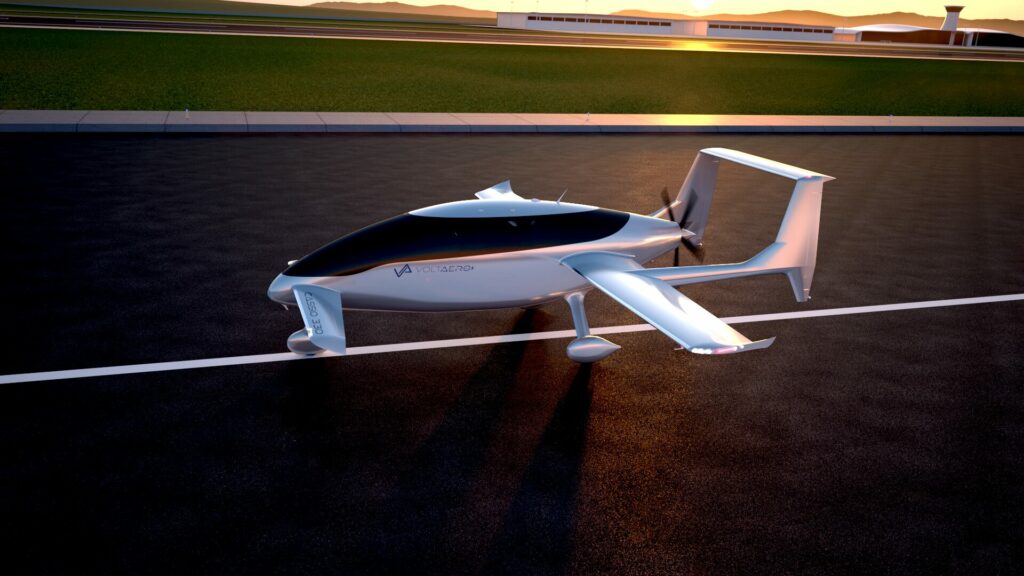

All these projects have been made possible by the injection of 95 million euros of European funds, proof that the “zero emission” aircraft is not just a fantasy, but a serious project supported by the institutions themselves. Aura Aero is not the only French company to illustrate the country’s ambitions for the electrification of aviation, since VoltAero is developing, from its HQ in Charente-Maritime, an aircraft called the Cassio 330, equipped with hybrid engines and scheduled for launch in 2026.

This is already attracting interest from investors, including the American company AltiSky, which has injected more than two million dollars into the French company as part of a partnership that will see the construction of a VoltAero plant in the United States to conquer the North American market, which is keen on these inter-regional solutions.

A worldwide craze for electric aviation

Of course, France is not alone in this booming market. While the international market is currently worth around ten billion dollars, the most optimistic forecasts suggest that electrified aeronautics could reach 70 billion dollars in annual revenues by 2034, with double-digit growth every year.

Ambitious projects are springing up all over the world. From Canada, where Harbour Air is retrofitting old planes with hybrid engines (the milestone of 100 flights was recently passed), to the UK, where ZeroAvia is making rapid progress on hydrogen, with a series of test flights and fund-raising events, and Sweden, where we are expecting the first test flight of a 30-seat hybrid plane from Heart Aerospace.

What about China? Unsurprisingly, CATL, the world leader in the market for batteries for electric vehicles, is spearheading the drive for electric-powered aircraft. In 2024, the group announced that its partnership with Chinese manufacturer Comac had given rise to a 4-tonne, 19-seater aircraft capable of flying 500 kilometres on electric power. There’s no doubt about it, the leading country for electric cars is determined to hold its own in the aviation market.