Venezuela has the world’s largest proven oil reserves, but its car market is on the verge of collapse: 20,000 to 30,000 new vehicles were registered in 2025, compared with almost 500,000 before 2014. Electromobility remains marginal, with around 0.1% of the total car fleet, or around 6,000 EVs at the end of 2024.

At the beginning of 2026, the capture of Nicolás Maduro by the United States reshuffles the deck and opens up new scenarios: possible lifting of certain sanctions, imports of EVs. Against this shifting backdrop, the question remains: is electromobility viable or just a green showcase?

A slow market

The Venezuelan car market has collapsed since 2014, following a major economic and social crisis. Prior to that date, nearly 500,000 vehicles were registered each year. The combination of falling local production, imports blocked by strict exchange controls (CADIVI) and economic sanctions has resulted in new car sales falling to a few thousand units a year.

Rising inflation (+200% by 2025) and the collapse in purchasing power have made it almost impossible for the average citizen to buy a new car, while political instability and massive demonstrations against the Maduro government have made matters worse.

Between 2023 and 2026, small EV initiatives emerged: pilot tests of micro EVs by Corpoelec and PDVSA, and grey imports from China and Colombia. At the end of 2024, the electric vehicle fleet is estimated at around 6,000 units.

However, out of the 25,000 vehicles sold in 2025, new EVs will account for just 0.4% of the market. These sales are concentrated among government fleets and the elite in Caracas, the capital of this country of 916,445 km². For the average citizen, the cost of an EV is still astronomical compared with the average monthly salary of around USD 195 to 200, and the fact that petrol is virtually free (USD 0.01/litre) continues to put the brakes on any mass adoption.

The EV market: symbolic rather than strategic

The electric vehicle fleet remains marginal. Fewer than 100 new EVs will be sold in 2025, with an estimated cumulative fleet of between 6,000 and 10,000 vehicles if all grey registrations are taken into account (purchased abroad – China, Colombia, Mexico, United States – then imported by a private individual, an independent dealer or an intermediary).

The BEV/PHEV split is around 90/10%, with hybrids still very rare.

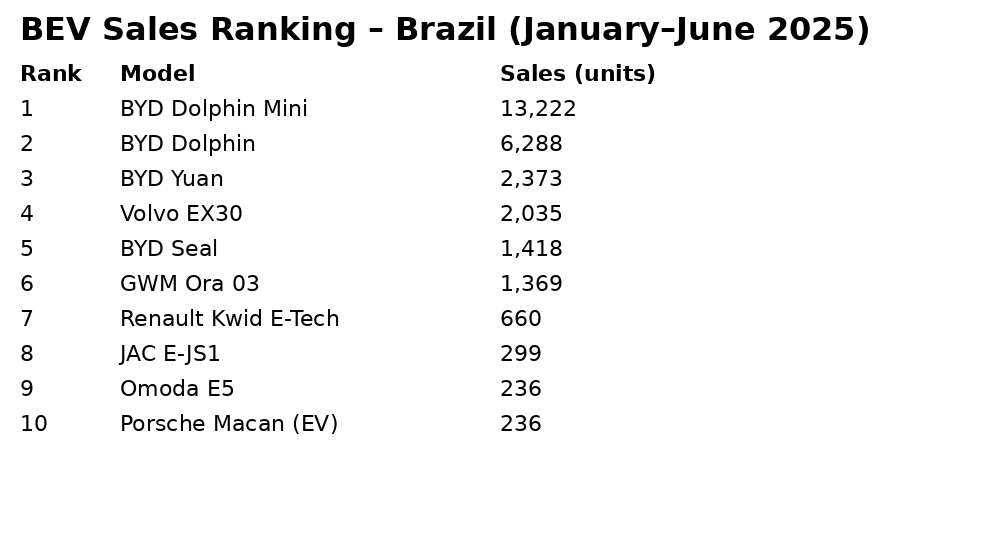

Compared with its South American neighbours, Venezuela has the worst record: in Brazil, the share of EVs is 5%, in Chile 3%, while Venezuela is stagnating at less than 0.1%.

Despite the low number of sales, official data show which EV models will be most popular in Venezuela in 2025:

- BYD (Seagull/Dolphin): around 50 units, mainly for Corpoelec/PDVSA fleets, priced at USD 15,000 to 20,000.

- Tesla Model 3/Y: around 20 units reserved for the elite of Caracas, price > USD 50,000.

- ZEV Motors: few units, used in particular for urban tests in Maracay, price ~ USD 10,000.

Players and industrial offer

On the industrial front, Venezuela has no battery production facilities. ZEV Motors assembles Chinese kits (City One), with a theoretical capacity of 500 units per year, but fewer than 50 vehicles are actually produced each year.

The foreign manufacturers present are limited: BYD and MG via Corpoelec, Tesla imported through grey channels from the United States or Colombia. Korean giants Hyundai and Kia are absent, despite their presence in Latin America.

Public policy and taxation: green rhetoric, oil reality

From a political point of view, there are no subsidies or bonuses for EVs. What’s more, almost free petrol remains the No. 1 cultural and economic brake. In 2024 and 2025, President Maduro made numerous public statements at international forums (COP29, the United Nations General Assembly and other summits), promoting a “transition to alternative energies” and “post-oil diversification”.

In fact, the Venezuelan economy remains dominated by oil: in 2024, the state-owned company PDVSA exported an average of more than 800,000 barrels per day, consolidating its position on Asian markets and beyond. These exports, which make up an essential part of the country’s income, remained at very high levels in 2025.

As for actions to democratise EVs in Venezuela, Corpoelec has tested 50 EVs in 2023 and PDVSA 10 Prius hybrids, but there is no target figure for 2035 or 2040. Customs exemptions favour the elite (Tesla), while taxes on conventional EV imports are as high as 100%. The policy remains focused on Caracas and Maracay, with oil-rich regions such as Maracaibo largely ignored.

Charging infrastructure: the bottleneck

The main drawback is that Venezuela has fewer than 20 public charging points, mainly in luxury hotels in Caracas. The ratio is one for every 300 EVs, an absurd figure for even an embryonic market.

Most domestic recharging is done on 110 V/220 V. Adaptation is essential, as most of these installations are equipped with back-up generators, due to power blackouts that can last up to 12 hours a day.

Innovative stations remain experimental: Swing Energy is testing solar micro-stations. There is no DC fast charging or smart charging, and the energy mix (hydro 60% unstable + gas/oil 40%) makes the CO₂ balance of an EV unfavourable in the local context.

Obstacles, paradoxes and challenges

As in many countries, a number of challenges persist, further delaying the adoption of zero-emission vehicles. The first is cost, which exceeds 1,500 times the average wage, widening inequalities: the elites drive Tesla cars, while the majority travel by motorbike or internal combustion engine.

Added to this are poor roads, the scarcity of new tyres, energy blackouts and free petrol, all of which reduce the incentive to change.

Venezuela is still the world’s biggest holder of oil reserves, but its electricity grid is regularly failing. Green ambitions remain largely symbolic, dependent on China for EVs and constrained by US sanctions. Scaling up Tesla or BYD therefore remains illusory in the short term.

A political turning point with possible consequences for electromobility

The beginning of 2026 marked a political earthquake in Venezuela, likely to profoundly alter the country’s economic and industrial context, including electromobility. On 3 January 2026, Venezuelan President Nicolás Maduro was captured by the US armed forces and transferred to New York to face federal charges including narco-terrorism and drug trafficking. This event ushered in a period of major uncertainty for Caracas.

If this situation were to lead to an easing of US sanctions, imports of Chinese EVs (BYD) and Tesla could be unblocked, enabling an immediate micro take-off (500 to 1,000 units in 2026, compared with less than 200 previously).

Under external supervision, strategic partnerships between local and foreign companies, and even industrial projects involving lithium and batteries, could be envisaged. Finally, pressure to rehabilitate the electricity network could reduce blackouts, increase the number of public charging points and improve EV charging.

This is not a prediction, but a potential scenario in which the policy could profoundly transform the country’s automotive landscape.

Outlook and scenarios for 2030

In the short term, if the structural imbalances persist, the fleet of electric vehicles could remain very limited, at less than a few hundred units, concentrated in Caracas and certain institutional fleets.

Conversely, a change in the political and economic framework, in particular a gradual normalisation of trade and investment, could pave the way for a more dynamic scenario: partial lifting of sanctions, the return of Asian industrial players, or even the establishment of local assembly plants.

Failing such an upheaval on several scales, Venezuela could follow an alternative, more informal path, inspired by other countries: electric and solar retrofitting of motorbikes and micro-vehicles.